When a creditor wants to inform a guarantor about the upcoming credit payment. He is required to formally inform the guarantor and the debtor before taking any legal action or filing a case against them. The demand on guarantor for payment is the formal letter or notification sent to the guarantor reminding him about the credit that he gave guaranty for.

Brief Description of Demand on Guarantor for Payment:

There are basically two types of loans or credits including secure loans and unsecure loans. In secure loans, the debtor pledges something with the creditor as collateral where in unsecured loan, there is no collateral involved and the creditor has to take the word from the debtor that he will return the loan. In unsecured loans, usually a guarantor is involved. A guarantor is a third party that insures the creditor that the debtor will return the payment on schedule or the creditor can take legal action against the guarantor. For example, person A has taken a loan from person B and the person C is the guarantor in this process. If the person B finds out that the person A can’t return the loan, he can ask the person C or the guarantor to force the person A to return the loan or he can also take legal action against the person C and force him to return by loan by himself.

Key Purpose of using Demand on Guarantor for Payment:

Unsecured loans are very common in friends, relatives and coworkers where a person asks for a loan to a person who he knows and is friends with. This process doesn’t require any collateral or real estate pledging but only a guarantor is involved and if the debtor denies paying back the loan or declares bankruptcy, the guarantor is legally obligated and forced to pay back the loan to the creditor. When a creditor requires his loan back, before he can take any legal action or file a case against the guarantor, he is legally required to inform the guarantor first in a formal way and give him duration to return the loan i.e. 15 days or 1 month. If the debtor doesn’t return the loan and the guarantor also informs the creditor that he can’t return the loan either, the creditor then has the right to take legal action against both of them i.e. debtor and the guarantor. The formal notification is sent to the guarantor by the demand notice or letter for payment.

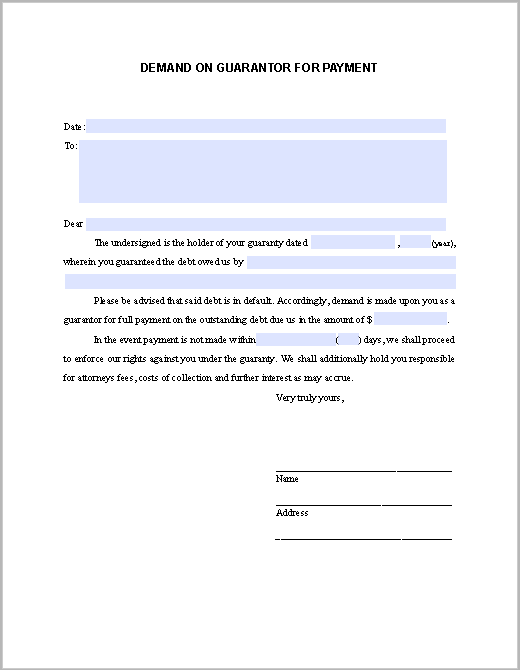

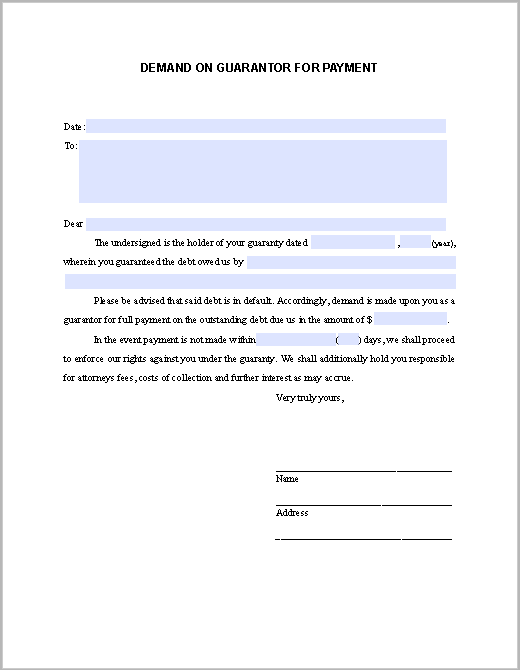

Key elements to include in the Demand on Guarantor for Payment:

- Name of the sender or creditor who is claiming the demand

- Include Name of the company or organization of the creditor

- Name of the guarantor who insured the credit

- Include Name of the debtor

- Details of the credit

- Date when the credit was given and guaranty was signed by the guarantor

- Duration in which the debtor or guarantor has to return the payment

- Legal steps that the creditor will take in case the loan isn’t returned

- Signature of the creditor

Here is preview of a Free Sample Demand Letter on Guarantor For Payment created as fill-able PDF,

Here is download link for this Demand Letter on Guarantor For Payment,