A Promissory Note is a written and sworn statement by the debtor or borrower stating that he in fact borrowed money from the mentioned creditor on the mentioned date and he is legally obligated to repay his debt by signing this note. Some people assume that a promissory note and a loan agreement are the same documents. But in reality, they are different as loan agreement has more legal value. You can challenge it worldwide whereas the promissory note doesn’t serve this purpose in a good manner.

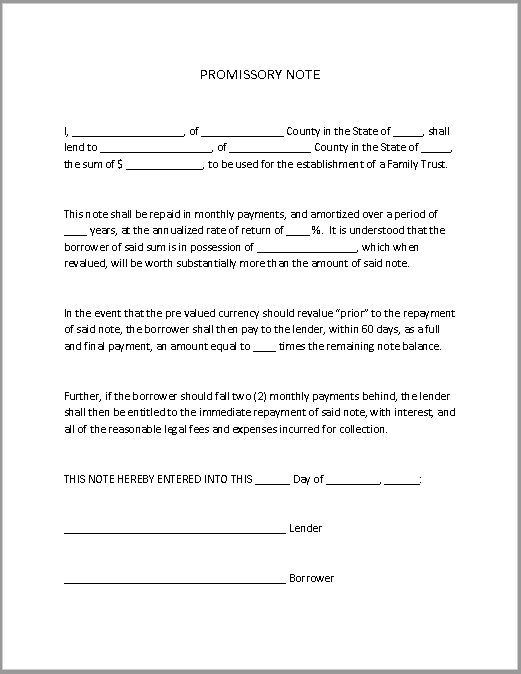

Promissory Note

Usually when you lend some money or get a loan from a bank or loan firm. You are required to sign a legal contract known as the loan agreement with the creditor. So that if you can’t pay back the debt or don’t pay back the debt on time, the creditor can use it for legal purposes. But, in common situations when friends lend money to each other or you borrow some money from your family member or relative, you don’t need to sign a loan agreement but you can also create and sign a promissory note by yourself. This Promissory Note Template state that you borrowed mentioned amount of money from the mentioned creditor and you swear to return the money whenever he demands for it.

Key Elements in the Promissory Notes

- Name of the debtor or borrower

- Name of the creditor or lender

- Date when the debtor borrowed the money

- Date when the debtor signed the promissory note

- Details of the loan (i.e. amount)

- Details of repayment of the loan (i.e. payment schedule, periodic installments and duration to pay back the loan in full)

- Sworn statement by the debtor that he has borrowed the money from the creditor and he is legally required to pay back his debt

- Mutually agreed terms and conditions of the note

- Signature of both parties

Using Promissory Note Templates

When we talk about promissory notes, most people think that this is a very convenient way to insure your debt but there are some flaws of this note as well as good benefits for each party. First of all, the most important benefit of promissory note is that it doesn’t require including a third party or any lawyer to draft the note but you can do it by yourself. Second, even if this is drafted by you, either party can use it in court in case of a dispute and this note can serve its legal purpose as the proof the debtor did borrowed money from the creditor and agreed to pay back his debt.

On the other hand, some setbacks of using promissory note include the lesser legal value of this note as compared to loan agreement. Another important thing is that if the debtor decides not to pay you the debt and disappears or moves out of the country, you can’t use the promissory note on international level. Also if you decide to use the promissory note and file a case against the debtor, this can cost you a huge deal of money because of the lower value of the promissory note.

Demand Notice to Pay Promissory Note

There are basically two types of loans including secured and unsecured but this is in case of formal or business loans issued by banks and loan firms where on the other hand, when two friends have a loan situation or if they are family members or relatives, they don’t need to sign a formal loan agreement that is much complicated. Instead, they can just use a promissory note in which the borrower states that he has borrowed a specific amount of money from the creditor and agrees to pay back the money whenever the other person demands for it. Later, when the creditor actually needs the money, he can make a formal demand by sending this demand notice to the debtor to pay the promissory note. There are many things included in this demand notice but the most important element is the formal notification to the debtor that if he doesn’t pay the promissory note on schedule, the creditor has the right to file a case against him and use the promissory note signed by him as legal proof in the court.

Here is preview of a Free Sample Demand Notice to Pay Promissory Note created as fill-able PDF form,

Here is download link for this Demand Notice to Pay Promissory Note,

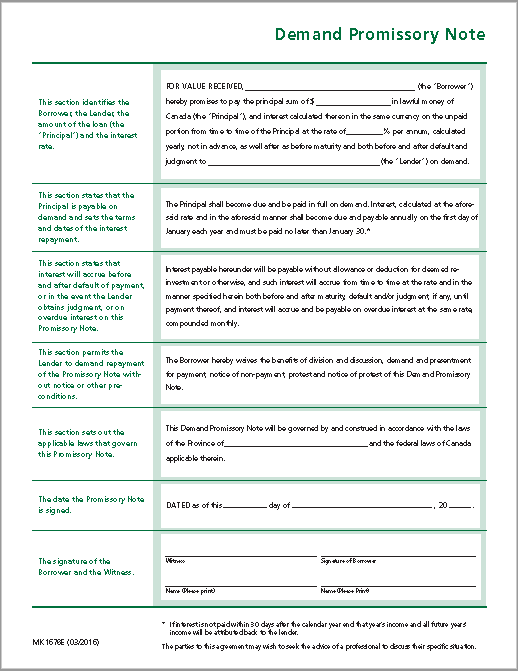

Demand Promissory Notes Template

Other than going in a bank or loan firm and getting a loan from there, when you get some money from your friend, you don’t need to include any legal help or sign a legal loan agreement but you can use a demand promissory note too. This note includes the names of debtor and creditor along with the amount of money that the borrower lent and the sworn statement that he is willing to pay back the debt whenever the creditor demands for it. This note is mainly used when you borrow money from your friends, family members, relatives and business partners without agreeing to a specific date or duration to return the money but just the fact that you can keep the money as long the creditor doesn’t demand for it and as soon he makes a formal demand, you will need to return it within the specified time limit.

Here is preview of a free Sample Demand Promissory Note created as fill-able PDF form,

Here is download link for this Demand Promissory Note,

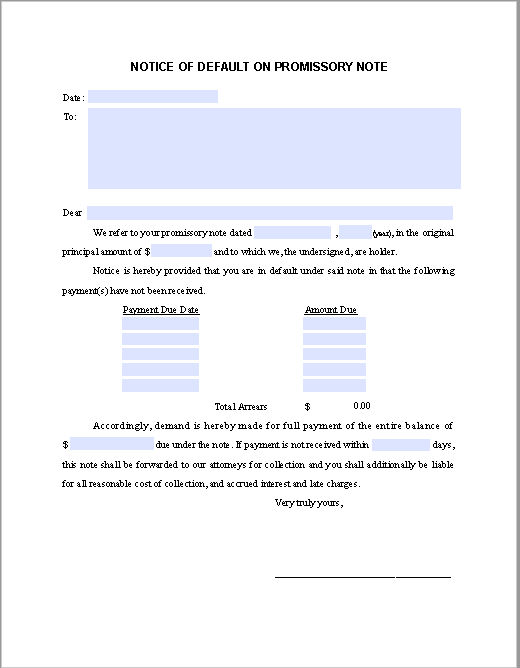

Notice of Default in Promissory Note

Generally when we talk about a person being default on his promissory note, this mistake violates the promissory note or loan agreement and the creditor has every right to take legal action against the debtor from filing a case against him to holding the guarantor responsible but before he does that, local laws force the creditors to give a last chance to the debtor so that he can explain himself and can try to resolve the dispute out of court and this is done by sending him a final notice of default in promissory note. Once it’s sure that the debtor has received the notice of default and hasn’t contacted the creditor for out of court settlement, the creditor then has the right to take further legal actions against him.

Here is preview of a Free Sample Notice of Default in Promissory Note created as fill-able PDF form,

Here is download link for this Notice of Default in Promissory Note,

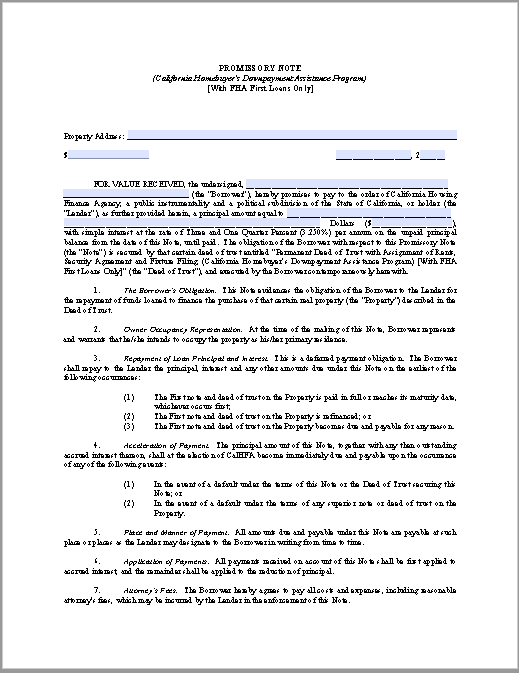

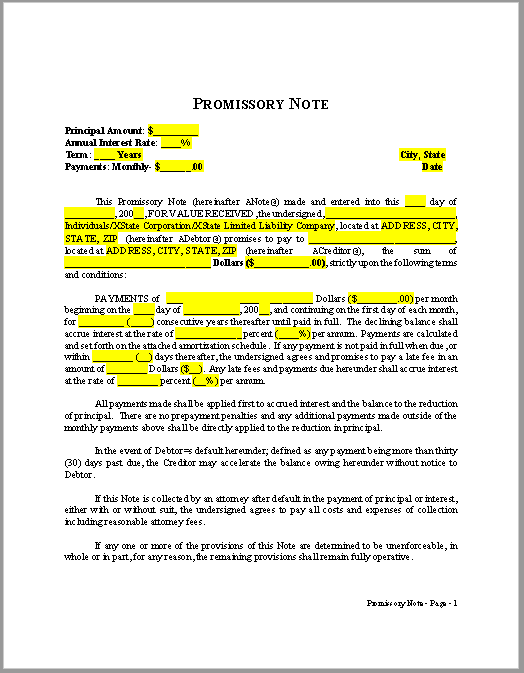

Free Promissory Note Templates

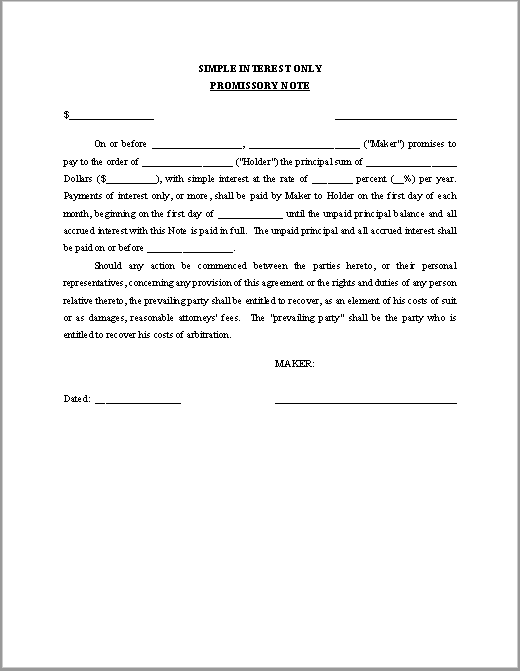

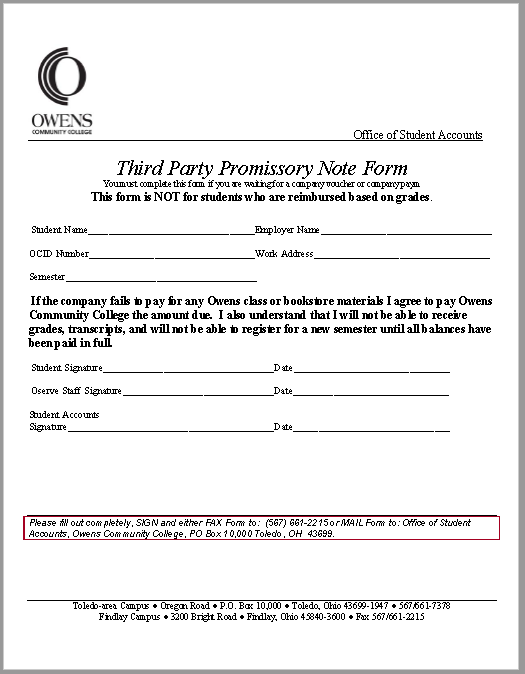

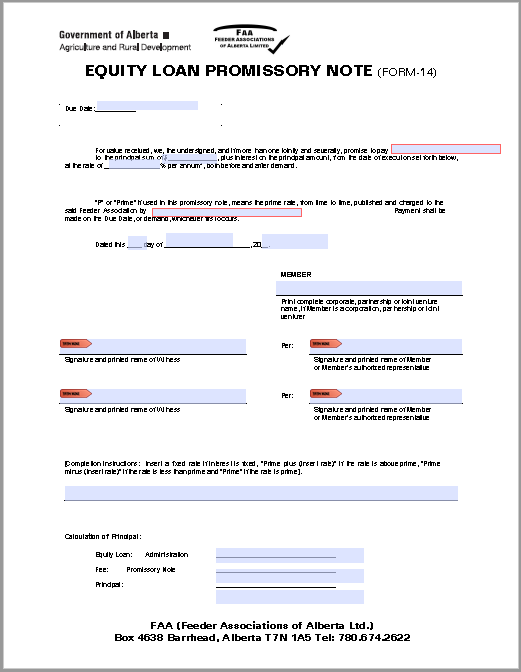

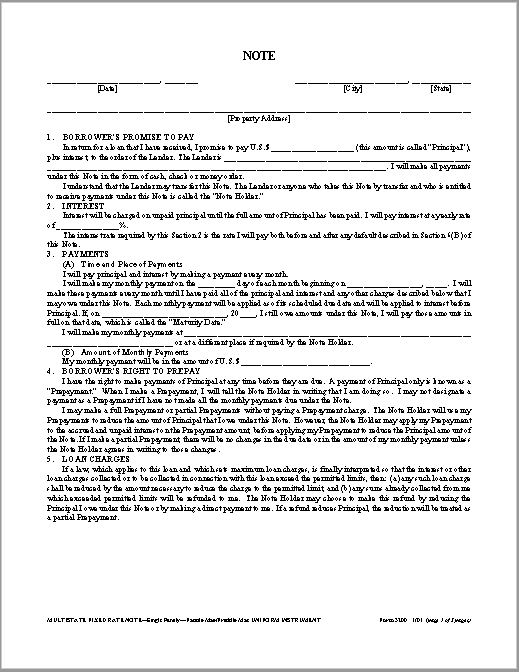

Here are previews and download links of these free Promissory Note Templates to help you prepare your own Promissory Note quickly and effectively.

Promissory notes are utilized like a document to record the facts associated with loan transactions between two or more individuals. The documents claims that the income borrowed will straight back be paid to the loan provider inside a specified time. These could be produced at any time associated with loan for making sure the payments which are safe.

Any type of financial loans must be reported utilizing this note, no matter whether the loan is just a repayment that is simple be made for the member of the family or perhaps a friend. The note has validity that is legal which the borrower is legitimately associated with keep carefully the guarantee of payment according to the agreements when you look at the note.

Types of Promissory Notes

Here are several types of promissory notes that we can find in our legal system.

Commercial

This type of note is reported according to the terms agreed by the lending company while the debtor. The lender can lawfully act resistant to the debtor by getting the possessions regarding the borrower as mentioned when you look at the document, if the debtor cannot repay his/her loan in this case. The lender can need for immediate payment this is certainly complete the maturity time plus don’t need certainly to await long to obtain the cash as installments from the person. Commercial note that is promissory rigid problems plus some additional appropriate conditions.

Personal

In most of the instances, you will have only agreement that is spoken members of the family or buddies when you borrow cash from their store. But contract that is verbal n’t have legal endorsement in process of law while you haven’t any proof regarding the loan borrowed from you. Your own observe that is promissory provide good faith on the debtor as well as a safety to the lender. You shall get these notes from offer stores or could be installed. Extent must certainly be included by you borrowed, stipulations for payment, interest rate and what action to be taken if the cash is not paid back.

Real Estate

This sort of note shall secure the loan lent by the debtor, but if she/he does not do so, the financial institution needs to pay the mortgage. So lender must include a home loan when it comes to loan provided to the borrower which supplies protection into the loan provider once the debtor does not repay the loan.

Investment

These records are employed in organizations in which the people will be the taking the chance of losing profits. So that the investment keep in mind that is promissory making the borrower to settle the loan disregarding the success of the organization. The note is operating as a currency with appropriate worth which could be traded in this instance.