Mortgage is type of loan that individuals and companies take from banks and loan firms. In this process, some kind of real estate property is pledged or given to the creditor by the borrower or debtor as insurance or guaranty of the safe return of the loan amount. This also explains that if a person can’t return his debt, the creditor has the right to foreclose the property and sell it to collect the debt.

Free Assignment Forms

We have several free Assignment Forms in PDF format to help you prepare your own Mortgage Assignment Notice as per your particular requirements.

Introduction to the Mortgage Assignment Notice:

Usually when an individual or a company gets loan from a bank or loan firm, they sign loan agreement with the creditor. In this agreement, the name of the creditor is clearly mentioned and this is the same person who will collect the debt from the debtor. There are some situations in which the original creditor meets with the debtor and informs him that from now on, the debtor has to make the loan payments to a new creditor i.e. bank or loan firm. When the debt collection rights are transferred from one creditor to another, this is known as the process of assignment of mortgage.

Key elements to include in the Assignment of Mortgage:

- Name of the person who got loan from the bank or loan firm i.e. debtor, with complete address

- Name of the person who lent money to the debtor i.e. creditor with complete address

- Name of the person, bank or loan person who will collect the debt from now on

- Date when the assignment document is being signed by the parties

- Details of the property being pledged with the loan firm including particulars i.e. area, location, market value etc.

- Amount of mortgage that the debtor took from the creditor

- Amount of debt that the debtor has returned to the creditor up until now along with the remaining amount

- Details of monthly installments of loan payments i.e.$5000, $10000 or any other figure

- Reasons of transferring or assigning the mortgage to a new creditor (not necessary)

- Signature of all parties included in the assignment process i.e. debtor, previous creditor, new creditor and witnesses

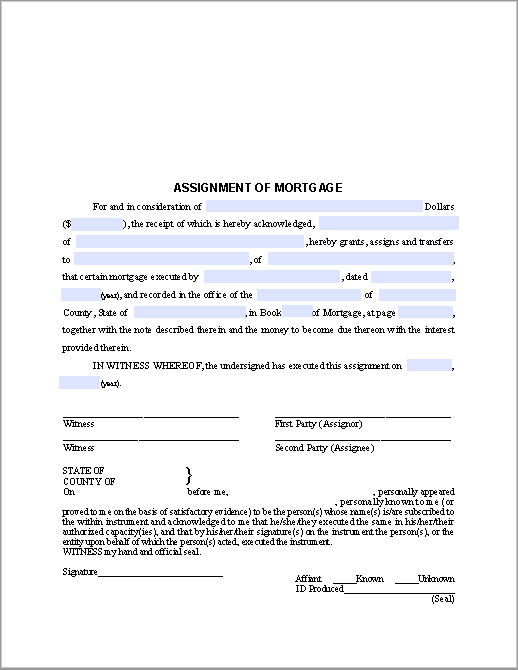

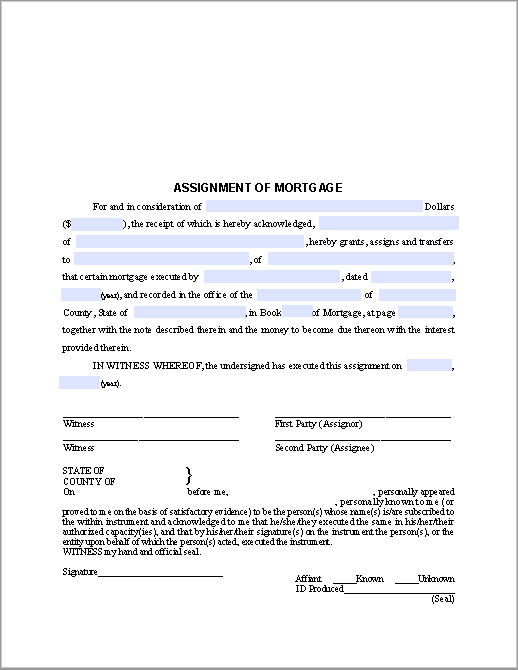

Here is preview of a Free Sample Mortgage Assignment Notice created as fill-able PDF Form,

Here is download link for this Mortgage Assignment Notice,